Our Case Studies

Project Name: Personal Budgeting and Forecasting

Client

The client intends to develop an online budget balancing system or money management system that creates financial order for household not having enough knowledge about Finance and personal accounting tools such as Quick-Books or Excel worksheets.Why STPL?

STPL has had experience in building applications with clean and easy to navigate user interface. The application proposed to be developed was particularly targeted to non technical and non financial user and hence ease of use and presentation are most critical. STPL was the right choice in view of their experience.Project Overview

This application basically is a home budget system in helping to organize household finances without having to track all expenses.

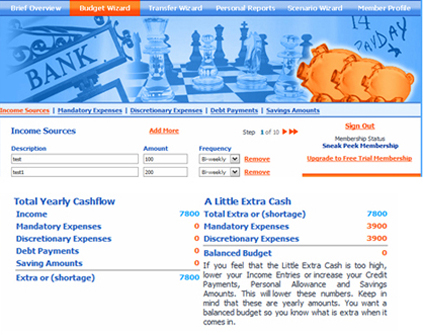

1. Budget Wizard

Using these wizard users can create a budget. This wizard is a 10 step process where user can enter.

Income Sources : User can add Income sources here.

Mandatory expenses : User can add your mandatory expenses here. These expenses are divided between three subcategories; Home, Transportation and Additional.

Discretionary expenses : You can add your discretionary expenses here. These expenses are divided between two subcategories; Living and Recreational.

Debt Payments : You can add your personal loans and credit card payments here.

Savings Amounts : User can add his savings here.

These savings are divided into two subcategories; Automatic Savings and Manual Savings.

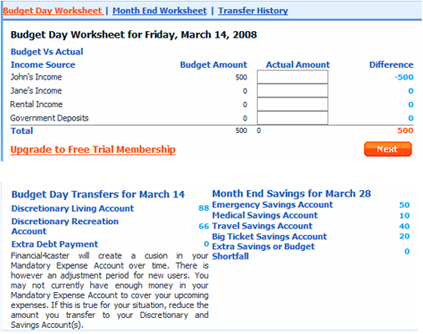

2. Transfer Wizard

Budget day worksheet -- The Budget Day Worksheet is filled in once a week on a selected budget day. It will tell the user what the account transfer requirements of the week are.

Other features in this module include Month end history and Transfer history

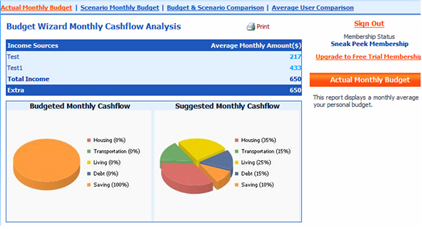

3. Personal Reports

This report displays a monthly average of personal budget.

Other features in this module include Scenario monthly budget, Budget and Scenario comparison, and Average user comparison

Challenges

As this project is related to the personal and family budgeting the main challenges were:1. To collect and categorize all kind of income sources and expenses.

2. To calculate the weekly and monthly budget shortfall or extra as soon as there is an income or expense.

3. To provide a facility to compare actual budget with a created scenarios.

4. To provide several reports and indicators for the any shortfall and extra in the budget.

Solution

For the challenges listed above we provided following solutions:1. We created several categories of income sources and expenses that a person or family may have.

2. We used client side scripting (JavaScript) and Ajax for better response and flicker free view of the information as soon as there is an income or expense.

3. We provided scenario wizards for the creation of scenario budgets and reports for their comparison with the actual budget.

4. We provided pie charts and several other types of reports related to budget based on income and expense.

We also provided indicators for budget shortfall (in Red) and extra (in Blue) so as the user is better informed about his financial situation.

Technology Used

- . NET FRAMEWORK 2.0

- ASP.NET 2.0

- C# 2.0

- AJAX

- XML

- CSS

- IIS 6.0

- Scripting Languages - JavaScript, VB Script

- Database - SQL Server 2005

- Web Services – Paypal Integration

- Testing Tools – QTP 9.2 , Dev Partner